Time and savings in the market economy are among the concepts that arouse our interest and they are among the real world economic principles examined here.

Last time we looked at the human spirit / order quadrant of the divine economy model.

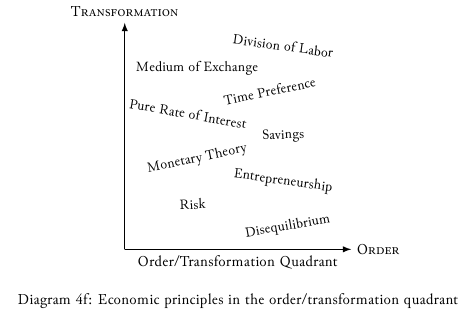

This is still Chapter Four. Now we will look at 9 economic principles and concepts and use the production possibilities frontier technique to show the relevance of these economic principles in the order / transformation quadrant of the divine economy model.

Let’s look at the Real World Economic Principles in the ORDER / TRANSFORMATION Quadrant

I have chosen nine economic principles for placement in this quadrant. These are the principles that find expression in and emerge from both the market and its capital structure. It is through the instrumentality of capital that the order of the market undergoes transformation. Equally symmetric and reciprocal is the vital need for the dynamic flow of information from within the market-process so that capital can exist and its structure can serve everyone’s needs. See Diagram 4f.

Division of Labor

Without necessarily recognizing the concept of the division of labor, humans have operated according to this universal law. Praxeology, which can be defined as action logic, identified division of labor as a universal law of human action.

The moment a choice was made for the sake of efficiency there was division of labor no matter how primitive the historical culture. It is difficult to imagine even an early stage in the history of mankind when some degree of this law did not operate. It is as old as humanity itself and it is inseparable from humans.

These steps of efficiency and this production of wealth, this division of labor, is essentially the beginning of capital. Therefore it is a misconception to separate capital and labor since they are intricately interwoven, ‘peas of the same pod,’ and variations on the same theme.

Division of labor is expressed in the market as a type of social cooperation that comes from specialization—physical and intellectual specialization. The idea that the market process is quietly consultative in nature—which is a very high form of cooperation—implies that there is an intellectual division of labor, or in other words, specialization contained in the wisdom of each of the market-process participants. The increased wealth that results from division of labor provides incentive for such specialization.

Savings in the economy comes from increased wealth which translates into the desire for more goods in the economy.

The existence of division of labor indicates that there is a desire for more goods in the economy. Division of labor brings capital into existence, provides for diverse wisdom to enter the consultative market process, and it generates wealth which provides incentive for even more division of labor. It is an act of social cooperation. Mises concurs:

In a hypothetical world in which the division of labor would not increase productivity, there would not be any society. There would not be any sentiments of benevolence and good will.

Medium of Exchange

As the division of labor continued and the economy evolved it was discovered that certain goods were basic to human well-being and therefore commonly sought after. Some of these basic goods were relatively less perishable and relatively easier to transport which made them valuable not only as a commodity but as a means of indirect exchange.

All over the world there were a myriad of mediums of exchange that emerged from different cultures. The most universally accepted medium of exchange that naturally emerged from the unhampered market was gold. It so happens—in contrast—that artificial mediums of exchange instituted by the interventionists are highly susceptible to corruption since they only exist because of a corruption of the natural processes of the divine economy to begin with.

Just as the market historically sifted through the alternative mediums of exchange and settled on gold, the test of a good medium of exchange is that it serves the economy and leads to further efficiencies. Confidence that it has value that cannot be destroyed makes it an effective economic means of traversing the time element. Overcoming this time element in the economy brings with it new and wonderful possibilities.

Once a medium of exchange is in place and universally accepted then all goods and services produced are valued in those terms. This was a major advancement since it made cost accounting possible. Both inputs and the goods and services produced were then in the same terms. From this point forward it was possible to evaluate and to determine profit and loss.

Savings in the economy comes from increased wealth which translates into the desire for more goods in the economy.

However if there is counterfeiting of the medium of exchange of any kind then the counterfeiters, who have not contributed anything to production, cause the exchange value of the money to decrease. Subsequently, the purchasing power of the money is negatively affected and it falls. The counterfeiters get something for nothing but the productive members of society are ultimately stolen from. This is true no matter who is the counterfeiter, the guy down the street or the central bank. Additionally, counterfeiting undermines the time element efficiency gains that come from having a perpetually good medium of exchange.

Time Preference

Time preference is the praxeological law that explains how humans value time. All humans prefer to have whatever good or service they need, now rather than later. They prefer to have the needed good now so if they have to wait then a premium is assigned to the good. The present good is equal to the same good in the future plus a premium.

Time preference is high or low but always positive. One way of understanding time preference is to recognize that there is always a ‘cost’ involved with saving until later rather than consuming in the present. It is either relatively high or relatively low. The higher the time preference the higher the discounting applied to the future. If people foresee war or fear for the future they will have a high time preference and will save less. In their eyes it is more costly to save.

If people foresee peace and prosperity on the horizon then they have a relatively low time preference and will be more willing to save. A lower time preference has a reciprocal effect, it brings about a higher degree of prosperity. Let us assume that I see good things on the horizon, like peace and trustworthiness. That makes me feel secure and confident about the future. As a result I will save if I have income greater than my current needs. My savings will then be used to advance prosperity.

Pure Rate of Interest

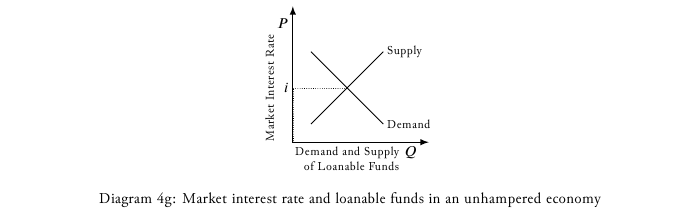

The premium assigned to future goods relative to the same goods in the present would represent the pure rate of interest at the individual level. The collective expression of this valuation for each culture is the pure rate of interest. The only way to get a sense of this expression of the cultural time preference is in the market since all real signals are sent within the market. What you find in the market is the market interest rate—which is the pure rate of interest, plus a premium to compensate for the risk incurred over time for the particular endeavor, plus a factor (that is often underestimated) which is an attempt to account for the changes in the purchasing power of the money if the money is being corrupted.

Savings in the economy comes from increased wealth which translates into the desire for more goods in the economy.

To get a realistic snapshot of the market rate of interest we look at the demand and supply of loanable funds. The amount of loanable funds available represents the supply side. The demand for loanable funds intersects the supply of loanable funds determining the market clearing price, which approximates the pure rate of interest. In brief, in an unhampered economy time preference is a major determinant of the supply of loanable funds and the demand for these loanable funds by entrepreneurs represents the demand side. See Diagram 4g.

Savings

The time element of the economy causes befuddlement among economists and non-economists alike. Savings is simply the allocation of income over time. Most understand that income is allocated among various goods and services in the present. For example, I spend some of my income on housing, food, clothing and entertainment, and that is understood. Expanding on this thought, now in addition to these I also allocate a portion of my income to a time horizon that extends into the future. This is savings. Savings then translates in the economy as loanable funds. The befuddled ones miss this point.

Savings in the economy comes from increased wealth which translates into the desire for more goods in the economy.

Economic growth is limited by loanable funds. Savings is simply another way of saying loanable funds. It is true that wealthier individuals have a larger portion of their income, in absolute and perhaps as a percentage of the total of their income, directed into some form of savings. These are the funds that people have willingly made available for use, in exchange for a rate of return based on their time preferences. Now, regardless of the current stock of savings and investment, the key to economic development is new and additional savings which releases new capital for use by entrepreneurs in already established and new productive efforts. This is what is meant by economic growth.

The market absorbs and conveys information about the present plus it conveys all of the time element information as perfectly well as is possible. Essentially, the market is in divine order.

It is one thing for the befuddled ones to miss the point that savings is simply an allocation of income over time, but it is quite another and more sinister thing for the befuddled ones to then impose acts of intervention on the market due to their ignorance of what savings is. An example of this would be lowering interest rates to encourage consumption and discourage savings. This act of interference is done because the interveners regard savings as the absence of consumption rather than as the conscious choice to consume at a later time. Intervention into this part of the economy, directed towards reducing savings, is extremely disruptive and it is destructive of capital.

Monetary Theory

Money is a medium of exchange that permits indirect exchange and brings about all the resulting efficiencies. Give consideration to these efficiencies by contrasting them with the awkwardness and impracticality of having to barter each and every time you wished to make an exchange.

One of the defining and determining qualities used when human societies chose its medium of exchange was the stock of money. Typically the medium of exchange was neither superabundant nor was it extremely rare. However once the medium of exchange is adopted in the market, because of its superior qualities and its performance as a medium of exchange, the stock of money is a non-factor. One stock of money is as good as another. If the demand for money increases it simply causes the value of each unit of money to increase.

Prices of all goods and services are in terms of money so the relativities expressed in the market are maintained, which means that the market functions as always, conveying information about the relative prices of goods and services. The divine economy equilibrates quickly and it instantaneously adjusts itself to each market interaction regardless of the stock of money.

Savings in the economy comes from increased wealth which translates into the desire for more goods in the economy.

The stock of money circulates in the present and connects the present to the future through savings. Savings represents loanable funds which becomes capital. Capital is what enables people to get paid now for their present services even though the ‘end of the line’ fruit of their work does not make it to the market until some time in the future.

The medium of exchange that is chosen in the divine economy— due to its merits—is universally and voluntarily accepted, partially because it cannot be manipulated artificially. One such example is gold. In other words, no amount of alchemy can create gold out of thin air, which means that there is no such thing as a business cycle in the divine economy. God does not play games with the economy or with mankind. However, the interventionists are playing a monetary game with the economy by manipulating the stock of money. One of the most visible consequences of their intervention is the repeated occurrence of a business cycle. It is the mismanagement of the monetary system by ego-driven interventionists that causes these business cycles.

Entrepreneurship

The spirit of entrepreneurship is uniquely human. It is the quality of being alert to possibilities. It is the driving force in the economy and it has origins in the disutility of labor. Even though all human beings possess various degrees of capacity for entrepreneurship most of the time for most people it is only a potential, resting in latency.

It is the interactions that take place in the market, the sparks of information there, which activate entrepreneurship. The most active entrepreneurs intentionally go to the market in an alert state methodically seeking arbitrage or other opportunities. They systematically seek prospective differences between revenues and costs in excess of the natural interest rate, taking into consideration price expectations. Some active entrepreneurs just happen to be at the right place at the right time but afterwards quickly return to latency.

There is some active entrepreneurship that is a response to a ‘gut feeling’ and some that comes from systematic calculation. Both are responses to opportunities perceived from the market information. The chances of success—yielding a profit rather than a loss—are greater when the entrepreneur has systematically examined the possibilities for profit or loss before taking action.

Savings in the economy comes from increased wealth which translates into the desire for more goods in the economy.

Regardless of whether it comes about from relative novices or experienced entrepreneurs the market process is driven forward by entrepreneurship. Opportunities are sought after and found. As described by Kirzner:

The entrepreneur’s activity is essentially competitive. And this competition is inherent in the nature of the entrepreneurial market process. Or, to put it the other way around, entrepreneurship is inherent in the competitive market process.

None of this happens in a risk-free world of certainty. In fact the exact opposite is the reality. What an entrepreneur may discover to be an opportunity may never materialize. What seems like good timing may fail in real time. Or to the contrary, the timing and magnitude and location of an endeavor may indeed satisfy the wants and needs of consumers significantly more—just as alertly discerned. Profits and losses are regulating forces and both are inherent in the market. A market that is uncorrupted by intervention—that is, a free market— allows the entrepreneur to most clearly perceive the signals needed to serve all of our needs.

Risk

Risk is an inevitable part of the economy because there is uncertainty and imperfect knowledge. But there are market equilibrating forces that moderate risk. Savings, for one, serves to mollify risk since savings can be used to meet an immediate need or it can be directed toward production for the future. If risk is of an actuarial nature then purchasing insurance will lead to a reduction of risk.

Savings in the economy comes from increased wealth which translates into the desire for more goods in the economy.

Entrepreneurs take on the role of major risk-takers and relieve others of that burden. Additionally, there is the likelihood that many of the entrepreneurs are skillful and have gained wisdom from their experiences, which skews risk towards success, lessening the degree of risk. For instance, entrepreneurs skillfully calculate economically using market information about relative prices, revenues and costs, and the availability of capital, which adds systemization and discipline to the decision-making process.

Finally, the level of charity that a society has reduces risk accordingly. If people care about one another they will give assistance when the unpredictable leads to misfortune. This lessens the risk for those affected by dire circumstances.

There is enough uncertainty and risk in the economy without more being created by the interventionists. The claim is made by those who interfere with the economy that they are reducing risk. What that actually means is that they are trying to reduce the risk for some particular favored group.

These ignorant or ego-driven interventionists do not and cannot fathom all of the negative consequences that result from their acts of interference with the market forces. Their disruption of the market process, in and of itself, increases risk for everyone, even the “protected’ and favored groups. Everything becomes riskier in a hampered economy since the flow of knowledge is impeded.

Disequilibrium

The fact that there is always uncertainty and imperfect knowledge implies that the economy is constantly in flux. Errors are inherent but fleeting; are followed by fleeting inherent errors again, and so on and so on. The equilibrating forces that operate in the market—one of them being entrepreneurship—constantly purge errors.

The forces underlying demand and supply move the economy towards equilibrium. Never is the economy in equilibrium but it is always tending towards it. Disequilibrium, with powerful tendencies toward equilibrium, is the norm. If errors persist and linger that indicates that the error has become institutionalized and to some degree impermeable to market forces. All institutionalized errors are caused by human intervention and prevent the full expression of the divine potentials of the economy.

Order / Transformation Quadrant Example—Savings

Let us examine the difference between human savings and the savings of a squirrel. Apparently both anticipate the future! The squirrel’s action is very strongly driven by instinct; however if environmental conditions change significantly the squirrel will modify the size of its cache. Likewise, human savings will be modified as a consequence of conditions. Human intelligence, which can span time conceptually and which can unravel the numerous and various complexities of the world, enables humans to save purposefully. Simply stated, savings is a productive and vital aspect of life.

Under the current system of economic intervention, the proponents of intervention come to the bizarre conclusion that savings is harmful. For example, Keynesian economics—a variant of which underlies the predominant economic systems practiced worldwide— demonizes people’s choice to save. Their forced incentives to diminish savings is like force-feeding the squirrels this year only to find that their essential cache for the future is completely gone, ultimately leading to disaster.

Order / Transformation Quadrant PPF Example

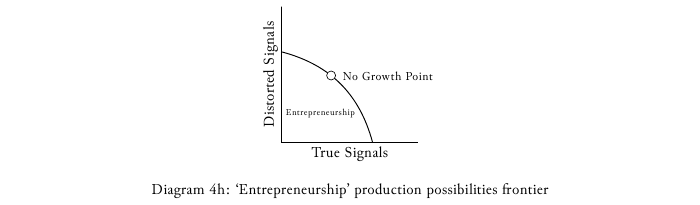

Since this example (savings/dissavings) is so similar to the one (the consumption/investment PPF) used when I introduced the production possibilities frontier concept in Chapter 3, I will select a different principle—different from savings—to use as the example for this quadrant. Let’s look at entrepreneurship. See Diagram 4h.

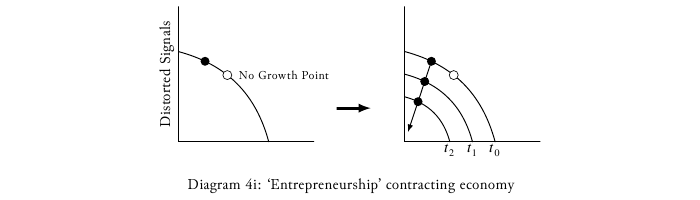

The ‘no growth’ point is where the potential of alertness is offset by distorted signals. As more and more economic signals are distorted the economy contracts as shown in Diagram 4i.

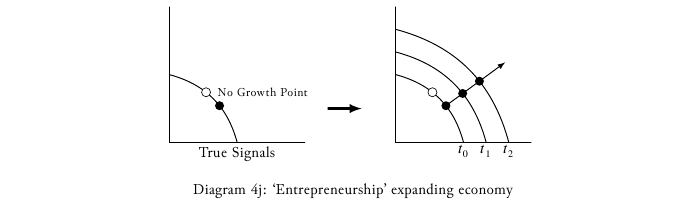

In an expanding economy the chances of successful entrepreneurship increase because the signals are real, and vice versa, since the signals are real the chances of successful entrepreneurship are greater. See Diagram 4j.

Savings in the economy

Summary of the Order / Transformation Quadrant

Born from the womb of the economy are such specializations as division of labor and medium of exchange. Unborn—time seamlessly connects the present and the future economy via the price known as the pure interest rate. Savings, or the supply of loanable funds, is available to be used for economic development by entrepreneurs who see discrepancies in relative prices in the present and over extended time periods. It is discernment of the interactions within the market process that transforms from latent to active each hopeful entrepreneur. Human intervention into the market distorts market signals and causes dire consequences in the present and in the future. These distortions, at least the ones stemming from artificial interest rates, are called malinvestments.

Selected Exercises

⒈ Develop an ‘Example’ for one of the specific principles, other than savings, in the Order/Transformation Quadrant.

⒉ Identify what the ‘no growth’ point represents for each of the nine principles in the Order/Transformation Quadrant.

Here’s the video recording of this session of the audiobook.

If you want to be notified at the time when the audiobook is Live on Facebook sign up here.

You can contact me if you have any questions.

You can check out all of the episodes by going to my YouTube channel.