Who doesn’t want to know how capital and labor work in the economy? Capital and labor in the market economy are among the concepts that arouse interest and they are among the real world economic principles examined here.

Last time we looked at the order / transformation quadrant of the divine economy model.

If you want to be notified at the time when the audiobook is Live on Facebook sign up here.

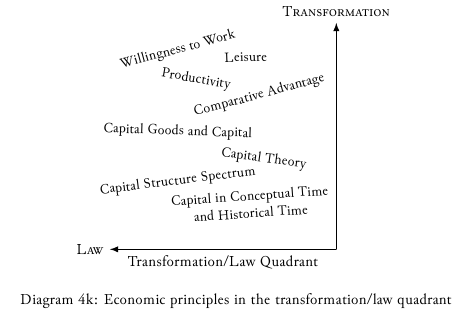

This is still Chapter Four. Now we will look at 8 economic principles and concepts and use the production possibilities frontier technique to show the relevance of these economic principles in the transformation / law quadrant of the divine economy model.

Real World Economic Principles in the TRANSFORMATION / LAW Quadrant

I have chosen eight economic principles for placement in this quadrant. These eight principles demonstrate reciprocal action within the continuum

bounded on one side by capital and on the other by property rights. This is a fascinating quadrant since it attempts to bridge the role of capital as it transmutes and transforms, with the non-transmutable nature of the law of human rights. See Diagram 4k.

Willingness to Work

If we assume that there is no coercion then the first order of incentive for the human being is to meet one’s own needs. Since it is possible to meet one’s own needs by taking action; that is what is done. What we acquire from our labor we are able to keep, presumably. It can be deduced that this basic property right is necessary and sufficient to make a person willing to work.

A negative corollary is that without the right to receive the fruits of one’s labor there would be an unwillingness to work. Nothing destroys the willingness to work faster than removing the human right to ‘reap what you sow.’

Leisure

Leisure is having the time to appreciate any wealth above basic subsistence. Leisure describes the circumstance that exists once all vital

needs are met and a choice is then made to refrain from work to pursue something more pleasurable. Consider the significance of leisure. Not

only does the transformation of labor into property give an incentive to work but acquisition of even a most rudimentary property right—here given as time to rest—gives one the right to make choices. As soon as there are choices there is the potential for leisure, for division of labor, for active entrepreneurship, and for the emergence of capital.

Productivity

The more productive one is the more property rights one acquires. The more property rights one has the more choices there are, which further cascades into more loci for entrepreneurial action and more diverse types of capital investments.

Technological innovation springs from these diverse types of capital

investments. Guess what? All of these lead to increased productivity. Productivity, then, is an expression of individual initiative and it leads to increased real wages.

Operating within this milieu is the productive actions of businessmen and the users of capital and it is their actions that generate profits. A portion of these profits then goes towards new capital in the form of wages and factor incomes. Businessmen and women and the users of capital play a guiding role, as stated by Mises:

What produces the product are not toil and trouble in themselves, but the fact that the toiling is guided by reason. The human mind alone has the power to remove uneasiness.

This advancing productivity is thoroughly described by Reisman:

The precise nature of the work of businessmen and capitalists

needs to be explained. In essence, it is to raise the productivity, and thus the real wages, of manual labor by means of creating, coordinating, and improving the efficiency of the division of

labor.

The cascading continues. If I am more productive then my real wage will increase which translates into more savings provided the future is

perceived as hopeful. This will create new capital which will be used to increase productivity.

Increased productivity can be defined as more consumer goods per productive unit. As the supply of goods increases the price of those goods decreases, which means an increase in the standard of living in real terms. What can be discerned from this is that property rights, which underlie productivity, serve as the foundation for development. Once the connection between property rights and productivity is understood

a new work ethic will emerge.

Comparative Advantage

Comparative advantage is a derivation of the concept of relativity. Regardless of absolute advantage every person or geographic unit has

a comparative advantage with regards some good or service relative to their trading partners. Trade occurs only if both sides benefit, implying

that there is a double inequality in exchange. Both trade partners value what they get more than what they trade away.

Comparative advantage is also a derivative of the division of labor. Trading partners will divide their labors so that each is producing and trading the good or service that enables both sides to maximize their

benefit from trade. This specialization from division of labor, combined with the secondary benefits that come from both trading and from maintaining a base of productive capacity, is what captures the benefits

of comparative advantage.

The resources that are uniquely mine as part of my skill set and my property rights are such that I have a comparative advantage with regards something, relative to my trading partners’ skills and property rights. If we engage in trade, the fact that we do trade means that we both have gained. Therefore the gain is in some degree an advancement which then can be consumed or otherwise used to expand my property rights —possibly into capital goods—either directly or indirectly through savings. To take full advantage of the opportunities that come from trade (exchange) I will specialize in producing the good or service in which I

have the relative (comparative) advantage.

Capital Goods and Capital

These are intermediate goods or producer goods which make it possible for consumer goods and services to be made more readily available and/or of higher quality. Capital goods initially require the use of capital to pay those making or using the capital goods until there is a flow of income from the ‘end of the line’ consumer good or service. It is easy to see that capital structurally exists in different stages of development. Some capital goods are already completed and are producing goods. Other capital is tied up in capital goods which still are not completed and still are not producing goods.

Capital is a loan of the fruits of past labor. The users of capital— capitalists—pay for the factors needed, either as wages or as factor incomes (to factors other than labor), as part of the production process. These wages and factor incomes are costs to the capitalist.

If the returns to capital are greater than the costs of capital then the capital value increases. Additionally, if new or free capital becomes

available it is alertly used since capital is the most limiting factor in the economy. Capital originates from loanable funds, that is, from savings. Just as economic growth is limited by capital, consumption is limited

by production. Notice the sequence for an advancing economy: savings

then capital then production of goods and services for consumption.

Something that has to be addressed: there is a severe prejudice towards the word ‘capitalist.’ The historical reason for this prejudice is outside the scope of this book. In the divine economy the capitalist is seen as a real and vital agent of the economy just like time is a vital element or entrepreneurs are vital agents, or just like property rights are considered as vital.

This book makes it clear repeatedly that there is a great deal of ignorance about economics and so there are many prejudices to be overcome. Mises broadens the view when addressing productive capital:

Production is not something physical, material, and external; it is a spiritual and intellectual phenomenon. Its essential requisites are not human labor and external natural forces and things, but the decision of the mind to use these factors as means for the attainment of ends.

Education is a type of capital. The education that is necessary for remedying the problems of economic prejudice and ignorance will not come from institutions that are funded by the interventionists. This book is one of the ways to gain clarity about economics, independent of contemporary prejudices.

Capital Theory

Of all the factors in the economy capital is the most limiting. Why? Look back at the sections about loanable funds and time preference. People strongly prefer things in the present. Therefore even under the most peaceful conditions only a small proportion of their incomes will be saved. Whereas the other half of the loanable funds market is the demand for loanable funds; and that is a function of what can be described as an intense and determined search for capital in the market.

Capital is the most limiting factor in the economy because it is constrained by loanable funds. The economy is also most limited by capital since capital is the transformational element of the economy which, of course, would make it highly sought after. Remember the earlier discussion about the efficiency gain that comes from division of labor. Well, it is capital that yields a cumulative and collective efficiency gain for the economy that dwarfs all of the other economic factors.

Capital is the key to progress. Once the primitive economy moved beyond individuals being self-sufficient but barely subsistent, capital became the means of payment to labor and other factors used in the production of goods. In reality there is no rivalry between labor and capital except in the fictional model of the world imagined by Marx and those who are like-minded, where capital is selectively excluded from the economy. Labor is intimately and ultimately the beneficiary of capital just as are the owners of the other factors of production.

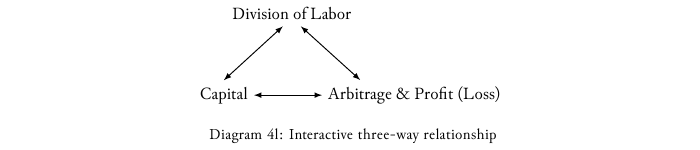

Let us consider the economically relevant subject of the formation of capital. Here, disutility of labor is a motivating element, as is time preference (which determines the level of savings). Refer to the interactive three-way relationship in Diagram 4l. Division of labor, a specialization that is an expression of human diversity, creates in the market loci for arbitrage and profit opportunities. This quickly draws the attention of alert entrepreneurs. Savings are then used as capital by the entrepreneurs to pay the wages and factor incomes until the time when revenues can. Sales revenue minus the money costs (wages and factor incomes) eventually yields a profit (or a loss). Some of the net income then re-enters as loanable funds, that is, as ‘new’ capital. Entrepreneurial alertness also contributes to the identification of ways to specialize, combining with

capital to augment the division of labor. See Diagram 4l.

Another interesting economic benefit from capital is the actual generation of information about both revenues and costs as a result of the application of capital in the economy. It is the involvement in the economy by capitalists that creates wages and factor prices (these are their costs) and sales revenues. These wage and factor prices serve as a source of information, enabling entrepreneurs and capitalists to calculate so they can make rational decisions. If we assume these decisions are from the market signals in a divine economy (in other words, in an unhampered,free market, laissez-faire economy), they are fully compatible with the divine concepts of unity and justice.

Another interesting economic benefit from capital is the actual generation of information about both revenues and costs as a result of the application of capital in the economy. It is the involvement in the economy by capitalists that creates wages and factor prices (these are their costs) and sales revenues. These wage and factor prices serve as a source of information, enabling entrepreneurs and capitalists to calculate so they can make rational decisions. If we assume these decisions are from the market signals in a divine economy (in other words, in an unhampered,free market, laissez-faire economy), they are fully compatible with the divine concepts of unity and justice.

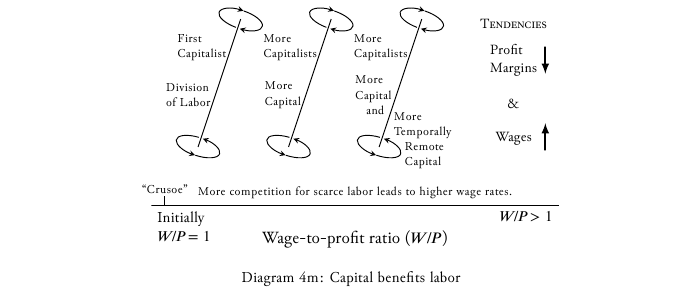

In a ‘Crusoe’ situation—one person isolated on an island—the initial payment for his initial work (his wage) equals his profit. He works by climbing a coconut tree and he eats the coconut (profit). At that point the wage to profit ratio is equal to one. Once there is an opportunity to specialize (trading with others in a market) and there is savings, capital enters into the scenario which potentially generates wages and factor incomes. To see how capital benefits labor, refer to Diagram 4m. Notice the intricacies that make up the economic definition of an ever-advancing economy.

If there are profits then that will end up creating ‘new’ savings. New savings means more capital which attracts those seeking capital.

As the number of capitalists increases wages and factor incomes increase because there is competition for these scarce resources which puts upward pressure on the wages and factor prices.

Division of labor at the early stages near ‘Crusoe’ was crude but as it is directed by businessmen and capitalists, division of labor becomes more refined. The process continues. Generation of wealth not only brings more capitalists to the market but it also leads to an expansion of the use of capital to more productive, temporally remote production processes.

As the number of capitalists increases the profits tend to decrease, with each getting a smaller portion, independent of the wages and factor incomes paid out during production. In other words, wages and factor incomes tend to increase while profits tend to decrease. Additionally, every innovation and improvement that comes from this process ultimately reaches the consumers who benefit from both better products and lower prices brought about by innovation. In summary, the wage to profit ratio (𝑊/𝑃 ) increases as civilization advances.

There is a tendency toward a uniform rate of return on all capital invested which closely approximates the pure rate of interest. Mises makes a similar observation:

The history of mankind is the record of a progressive intensification of the division of labor—The operation of the principle of division of labor and its corollary, cooperation, tends ultimately toward a world-embracing system of production.

Business cycles do not occur in the divine economy since none of the signals in the market are distorted. The market interest rate truly reflects the amount of savings that people have, creating a balance throughout

the capital structure between the present and the future. When an artificial interest rate is created by the deceitful practices associated with fiat currencies the entrepreneurs allocate capital incorrectly—in both the amount invested and the capital invested temporally across the time

horizon—which leads to a business cycle.

If we make an assumption—that there is only a single act of intervention—then all the malinvestments would be purged by the divine economy during the passage of one business cycle. But since resources are allocated across a span of time and across a spectrum of capital structure, a business cycle is not merely something that happens

at one specific point in time. The negative consequences manifest themselves over many time periods or until all the malinvestments are

purged for the duration of that cycle.

If consumer credit is extended in the market artificially, which means that it is unmatched by existing savings, capital is consumed. What is happening is that consumption is in excess of the productive capacity. Productive capacity in the economy is supported by the level of savings and the subsequent capital. The only way to now consume more is to use current savings, which was to serve as the loanable funds for ‘new’ capital and economic growth. This is the equivalent of consuming capital which consequently will cause the economy to regress, the typical consequence of intervention.

The important point to note here is that the divine economy heals itself and cannot be destroyed. All disruption and disorder in the economy comes from corruption caused by human intervention. Equilibrating forces begin to clear these afflictions almost immediately after intervention is halted. Rest assured that the power of the divine economy is indestructible and self-healing.

Capital Structure Spectrum

Production of all types requires capital. Some capital may be needed for a short time like a day or a week or a month. Other capital needs to suffice production for years. The picture that emerges is a wide array of production, funded for varying lengths of time, all of which makes up the capital structure funded by savings.

The starting point of an endeavor is very significant. If there is plenty of capital available at the beginning then the scale of production can be of a greater magnitude. Likewise, if there is plenty of capital the temporal remoteness from the consumer good can be greater. In other words, there can be more research and development when capital is relatively plentiful, which ultimately makes the possible fruits of that endeavor greater.

The concept of originary interest is closely related to time preference but it can be used to explain a different aspect of the economy. Originary interest is another of the praxeological laws that describes how humans act. People act in such a way that demonstrates that they value present goods higher than those same goods in the future, in relative terms.

In and of itself originary interest explains why people take action in the present. Without this conceptual reality operating in the human psyche there would be no consumption since there would be no preference for anything now. Humans devoid of originary interest would have no motivation to eat now, in the present, which would cause the species to go extinct. Needless to say, human beings do, indeed, place a high valuation on the present.

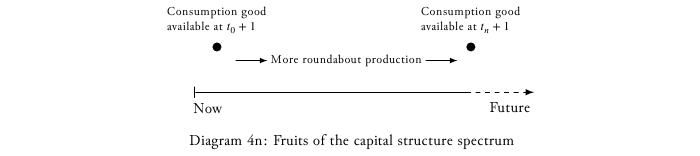

After considering all of these points it becomes clear that capital structure is really a spectrum. The most immediate end of the spectrum is current consumption: say, ice cream about to be selected from the freezer at the store. The more roundabout means of production, those that are temporally remote from the consumer, are located towards the other end of the spectrum. Capital is heterogeneous and inherent, beginning with consumption goods at the most immediate end of the capital structure spectrum. See Diagram 4n.

The capital structure spectrum is a conceptual representation of the various fruits of capital (consumption goods) over time. This idea of one spectrum for all the various forms or structures of capital serves as another proof of the inseparability of capital from the consumption choices made to sustain and satisfy life. There is nothing evil about

capital, in fact, capital is simply a vital element of the economy.

Capital in Conceptual Time and in Historical Time

When there appears to be no time other than the present (𝑡 = 0) the originary interest tells us that all consumption would be immediate. There would be no savings. When the time horizon expands (𝑡 + 1) the originary interest tells us that priority is given to the present time but that a pool of funding will begin to form unless, that is, the economy is in a primitive condition of basic subsistence. Of course the concept of time implies that there is a future. Thus, conceptual time shows that capital inevitably forms.

When the economy began in its simplest form, which let’s say occurred at 𝑡 = 0, the effort made just for survival meant that the gain (profit) was equivalent to the compensation for the labor (wage). In other words, the hunger was satisfied or the thirst was quenched. As the economy evolved (𝑡 + 1) and progressed past subsistence due to the development of division of labor, capital became available to pay wages and factor incomes (money costs) and the capital structure formed. Then the ‘revenues minus costs’ information brought about the ability to calculate which then enabled entrepreneurs to drive the economy forward. Historical time shows that capital emerges and serves to continually increase the wage-to-profit ratio. Notably, labor and productive factors are the beneficiaries of capital.

Transformation / Law Quadrant Example—

Comparative Advantage

Comparative advantage operates in human society because human beings are complex and they have a plethora of needs and wants. To some extent geographic distances act as a limitation. Since there are numerous trading partners with a great diversity of special skills and talents, all of whom also have a great number of needs, the law of comparative advantage operates without fail.

This law can be violated causing great harm to all and especially to those whose alternatives are the most limited. One example of intervention that does this type of damage is any kind of trade barrier, for example, tariffs. A regional, simple economy may need to have free access to markets for their comparative advantage to be realized. Tariffs may destroy the feasibility of its comparative advantage, depriving this simple regional economy of the ability to transform itself. Without such interference the law of comparative advantage would activate all the agents of prosperity: division of labor, then trade, and possibly savings, capital, and entrepreneurship—that is, if we assume that property rights exist.

Transformation / Law Quadrant PPF Example

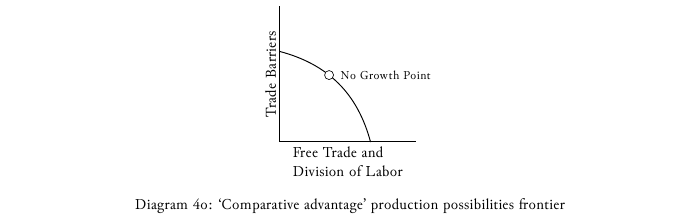

The ‘no growth’ point in this example (Comparative Advantage) is where free trade and division of labor are offset (negated) by trade barriers. See Diagram 4o.

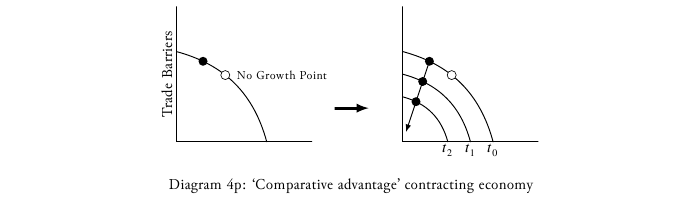

As more trade barriers are raised there is less ability to take advantage of the division of labor. The result is a contracting economy. See

Diagram 4p.

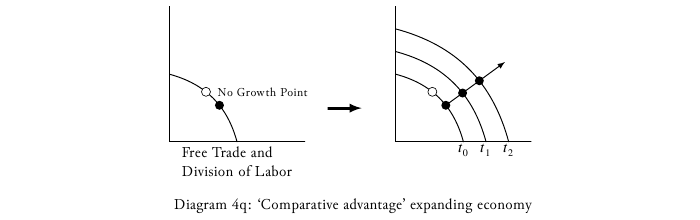

Free trade increases the division of labor which leads to wealth-generating

specialization and capital formation. In this environment the economy expands. See Diagram 4q.

Summary of the Transformation / Law Quadrant

The divine economy rests firmly on property rights. In contrast, what suffers most in an economy hampered by weak property rights is people’s willingness to save and the ability for capital to accumulate. The economy then loses its power to transform. The divine economy has an intricate capital structure which acts as an agent of transformation leading to economic development. Built into the divine economy are all the incentives that encourage movement towards more choices and towards the use of capital.

Selected Exercises

⒈ Identify the ‘no growth’ points for each of the eight principles in the Tranformation/Law quadrant. Compare them in a simultaneous equations format and come to at least one conclusion.

Examples of simultaneous equations:

From last section:

Entrepreneurship + True Signals = Expanding Economy

From this section:

Free Trade + Division of Labor = Expanding Economy

⒉ Now state the conclusion that you arrived at in exercise one in terms of a non-interventionist policy.

Here’s the video recording of this session of the audiobook.

If you want to be notified at the time when the audiobook is Live on Facebook sign up here.

You can contact me if you have any questions.

You can check out all of the episodes by going to my YouTube channel.

If you want to go to the first episode go here.